Pazit: Planning For The Future – An Interview with Tamar Snyder

By Michelle Katz

Posted Jul 01 2009

Even if you’re not the type of girl who would swipe your credit card at the drop of a hat, or at the sight of the cutest pair of Coach shoes you’ve ever seen, chances are you’re still in need of financial advice.

Tamar Snyder recognizes that most young women have unfortunately not been given the proper tools they need to manage their money. Married or single, young women are in need of some guidance regarding their finances, especially in today’s frighteningly unstable economy. Pazit’s here to help!

Ms. Snyder recently spoke with The Jewish Press:

Michelle Katz: What inspired you to start this organization?

Tamar Snyder: When my husband and I got engaged, we were bombarded with a plethora of well-meaning advice on where to shop for gowns, which flowers to choose, and how to improve our relationship with one another (“Never go to bed angry “). Yet few family members and friends offered up any words of wisdom focused on our finances. Thankfully we were both raised in fiscally prudent homes. And so we sat down together and crafted a budget, set savings goals, and decided how we wanted to allocate our tzedakah for the year to come. We also made sure we were living within our means so we could invest our wedding presents to eventually pay for the down payment on a future home.

Unfortunately, many young couples in the frum community simply don’t plan financially for the future. Either they just don’t know how or they’re hoping G-d will provide without any effort on their parts. I think it’s more of the former than the latter, as well as a feeling of overwhelming hopelessness when faced with the myriad of costs necessary to lead a frum lifestyle – from kosher meat and tuition to shul membership and building fees. While I can’t solve the tuition crisis, I can help educate Jewish women (and the men they love) to confidently manage and plan for their financial futures. When a husband and wife see eye-to-eye financially, they’ll have fewer arguments and more shalom bayit, in addition to a better-looking bottom line.

What are your goals with Pazit?

Pazit (www.pazit.org) is a nonprofit organization dedicated to empowering Jewish women who want to take control of their financial futures. Many Jewish women whom I have interviewed say that while they pay the day-to-day bills, they leave the bigger financial decisions (such as allocating their 401(k)s and speaking with a broker or financial adviser) to their husbands or fathers. Even in the most loving marriage, this leaves them financially vulnerable. Pazit’s goal is to help Jewish women overcome that internal voice that tells them they cannot understand their finances. Pazit’s first public event (open to men and women) took place in Washington Heights and featured SerandEz’s Ezzie Goldish, who revealed the initial findings of his Jewish Economic Survey (see http://www.serandez.blogspot.com) to determine just how much money it takes to lead an Orthodox lifestyle. More than 60 people showed up, and a lively Q&A took place after Goldish’s presentation.

What’s next for Pazit?

Pazit is launching a Money Club that will provide groups of a dozen or so Jewish women a safe space to talk and learn about money. The sessions – which will focus on budgeting, savings, investing, debt, and philanthropy/tzedakah – will be infused with Jewish values. The goal is to gain crucial knowledge while shattering the taboo surrounding talking about money, a taboo that is especially strong among Jewish women. The pilot Money Club is booked solid, but those who are interested in attending or hosting a future Money Club are welcome to e-mail me at tamar@pazit.org.

How did you choose this unique name for the organization?

Pazit means “pure gold” in Hebrew. An Israeli friend of mine suggested it, and I liked the name because it has a feminine feel to it. At Pazit, we believe that money is a means to an end. The true goal is to manage your money in a way that allows you to lead a golden life, one that is well aligned with your values.

Why have you chosen to include young women, and not young men who might also possibly lack the financial independence that those in the secular culture are privy to?

While both men and women can benefit from financial literacy initiatives, Jewish men are more likely than women to gloat to one another about the great interest rate they found or how their stock has jumped even during this down market. Women, on the other hand, boast about how they saved $20 on a pair of shoes at DSW. The women aren’t saving; they’re spending. The key is to render it socially acceptable for women to talk openly about investing, and to feel comfortable consulting one another for financial advice.

Why are Jewish women at more of a disadvantage than their non-Jewish peers when it comes to money matters?

That’s a great question – and an area that Pazit is hoping to study in greater depth. Anecdotal evidence suggests that Jewish women are more likely to suffer from the “Balabuste syndrome”; they feel a need to satisfy everyone else’s needs before their own. This self-sacrifice often costs them, especially when it comes to finances. While women tend to live longer (necessitating a bigger retirement nest egg), they spend less time, on average, working fulltime and therefore don’t necessarily invest as much or as often in their 401(k)s or other retirement accounts. There’s also a tendency among Jewish women to feel insecure and experience a lack of confidence when it comes to taking care of the big-picture finances – such as investing, purchasing a home, and meeting with a financial adviser. These are generally viewed as male-dominated tasks.

What is your advice for recent college grads facing student loans, a slumping job market, and rising daily living costs?

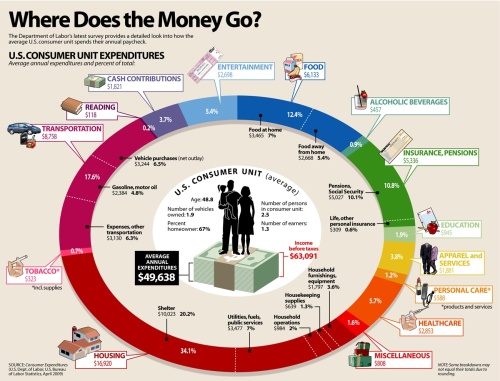

Before choosing an apartment or deciding where to live, it’s important to take a hard look at your finances by creating a budget. Budgeting isn’t fun, but you’ll feel much better once you gain clarity. Start out by looking at your paycheck and figuring out how much you make each month – after taxes. Your expenses, including student loan payments, must be lower than this number.

Determining your expenses is trickier. An easy way to do so is to log onto a free personal finance site like Mint.com, Quicken Online, or Thrive (justthrive.com). The site will automatically show you how much you’re spending on food, gas, and other categories. Then fill out Pazit’s budget worksheet, available on our blog, http://www.pazitgold.wordpress.com or by emailing tamar@pazit.org.

As soon as you land a job, you should try to max out your 401(k) if you have that option, or at least put in enough to get a match from your employer (if your employer offers matches). If you’re in school and working part-time, open a Roth IRA and try to deposit the maximum annual contribution ($5,000 in 2009). Money in a Roth IRA grows tax-free and is not subject to taxes upon withdrawal (though some restrictions apply).

Get in the habit of paying yourself first. Arrange for a portion of your paycheck (be it $50 or $500) to be automatically deposited into a high-yield online savings account. Right now, the “high-yields” are a measly two percent. But that’s a big improvement over the one-half percent your local bank is offering. And, because the money is in an online bank, you’ll be less likely to spend it. Research indicates that those who save with a particular goal in mind are much more likely to succeed. Mint.com allows you to create different savings goals, such as an upcoming vacation or a future down payment on a home.

What about newlywed couples struggling to get off the ground?

Financial planning should begin before the chuppah. In fact, singles are often in the best situation to sock away money to ensure that they’ll be able to live their lives the way they want, once day school/yeshiva tuitions and mortgages become a reality.

For newlyweds, I recommend that they spend a Sunday afternoon reviewing their expenses for the past several months, crafting a realistic budget, and talking about their attitudes toward money. Some questions to ask one another: Are we giving enough tzedakah, and are we giving it systematically to the organizations or causes we most believe in? What are our three top savings goals for the next six months, five years, etc.? Often, husbands and wives disagree about how money should be spent or saved. One spouse might want to take a vacation, while the other is worried about diminishing the savings account. The key is to be aware of your financial situation, and communicate honestly and openly about money matters.